In this engaging presentation, the presenter introduces viewers to the Forex market, showcasing its worldwide significance. The Forex market unites various country-specific stock markets under one umbrella, emphasizing currency trading. Major financial hubs like Tokyo, Hong Kong, New York, Sydney, Frankfurt, and London are highlighted as key players, enabling 24-hour trading due to their different time zones. The presenter explains the market's inherent volatility driven by diverse participants and global economic events, discussing the potential for both opportunities and risks. The presentation promises an exploration of the market's impact on global economies, the factors influencing currency fluctuations, and trading strategies, inviting viewers on an exciting journey of discovery in the dynamic realm of Forex trading.

In this captivating presentation, the presenter immerses the audience in the realm of Forex trading, emphasizing the dynamic interplay between opportunities and risks that define this financial landscape. Drawing parallels to fishing in a vast sea, the presenter underscores the immense potential within the Forex market, the world's largest financial arena with a daily turnover of trillions. Risk is reframed as an opportunity in Forex, characterized by transparency and manageable risk factors. The presentation highlights the market's accessibility across global financial centers, operating 24/7 and allowing for flexible trading hours. Comparing risks to other business ventures, the presenter underscores how Forex offers greater opportunities, provided one possesses the right knowledge, strategy, and discipline. The potential for substantial profits is acknowledged, along with the importance of continuous learning and risk management. Ultimately, viewers are encouraged to embrace the Forex market's opportunities with confidence while navigating its inherent risks in a positive and informed manner.

In this compelling presentation, the presenter introduces viewers to the Forex market as a transformative avenue toward wealth creation and financial independence. From different perspectives including job, self-employment, business, and investment, Forex's potential to reshape financial landscapes is explored. As a job, it offers flexibility and the prospect of self-driven success; as self-employment, individuals become CEOs of their trading businesses with autonomy and rewards tied to performance. Approaching it as a business involves strategic planning and adaptability, akin to any entrepreneurial venture. For investors, Forex provides opportunities to grow wealth through capital allocation and professional management. The market's capacity for generating income regardless of market direction and leveraging capital is emphasized. Achieving financial independence is highlighted, underscoring how Forex can create diverse income streams. Success, however, hinges on dedication, patience, and continuous learning. The presentation inspires embracing Forex's challenges, arming oneself with knowledge, and crafting effective strategies for navigating this dynamic market. Viewers are invited to join an exciting journey to explore Forex's wealth potential and pathways to financial autonomy.

In this informative presentation, the presenter addresses a fundamental aspect of Forex trading – the types of brokers – and highlights the importance of understanding these distinctions to make well-informed choices. Two primary categories are discussed: dealing desk and non-dealing desk brokers. Dealing desk brokers, often counterparty to traders' transactions, might profit from clients' losses, potentially creating conflicts of interest. Non-dealing desk brokers are then explored, with a focus on Straight Through Processing (STP) and Electronic Communication Network (ECN) brokers. STP brokers connect trades with reputable liquidity providers, ensuring transparency and minimal conflicts. ECN brokers take it a step further by linking to multiple liquidity sources, delivering swift and efficient execution. Morfin FX is positioned as an STP and ECN broker, offering traders a balance between transparency and extensive liquidity. The presenter emphasizes the importance of choosing a broker that aligns with trading goals, risk tolerance, and desired transparency levels. The presentation concludes by inviting viewers to join Morfin FX for a trading experience rooted in integrity and efficiency.

In this enlightening presentation, the presenter delves into the intricacies of the Forex market, shedding light on its structure and dynamics. The Forex market, a decentralized global platform for currency trading, operates 24/5 across various financial centers. Its composition includes banks, financial institutions, corporations, and retail traders, each fulfilling distinct currency-related needs. The interbank market plays a central role, where major entities exchange currencies, establishing liquidity and exchange rates. Liquidity providers ensure a smooth flow of trades, enabling competitive prices. Forex brokers act as intermediaries, connecting retail traders to the interbank market, facilitating orders' execution and often offering additional services. The constant transaction flow among participants shapes exchange rates and prices, while market sessions across different time zones create continuous trading opportunities. The presenter emphasizes the significance of regulatory compliance and safety in trading, advocating for choosing regulated brokers like Morfin FX. The presentation concludes by inviting viewers to Morfin FX for a secure and transparent trading experience, encouraging exploration of the vast opportunities within the Forex market.

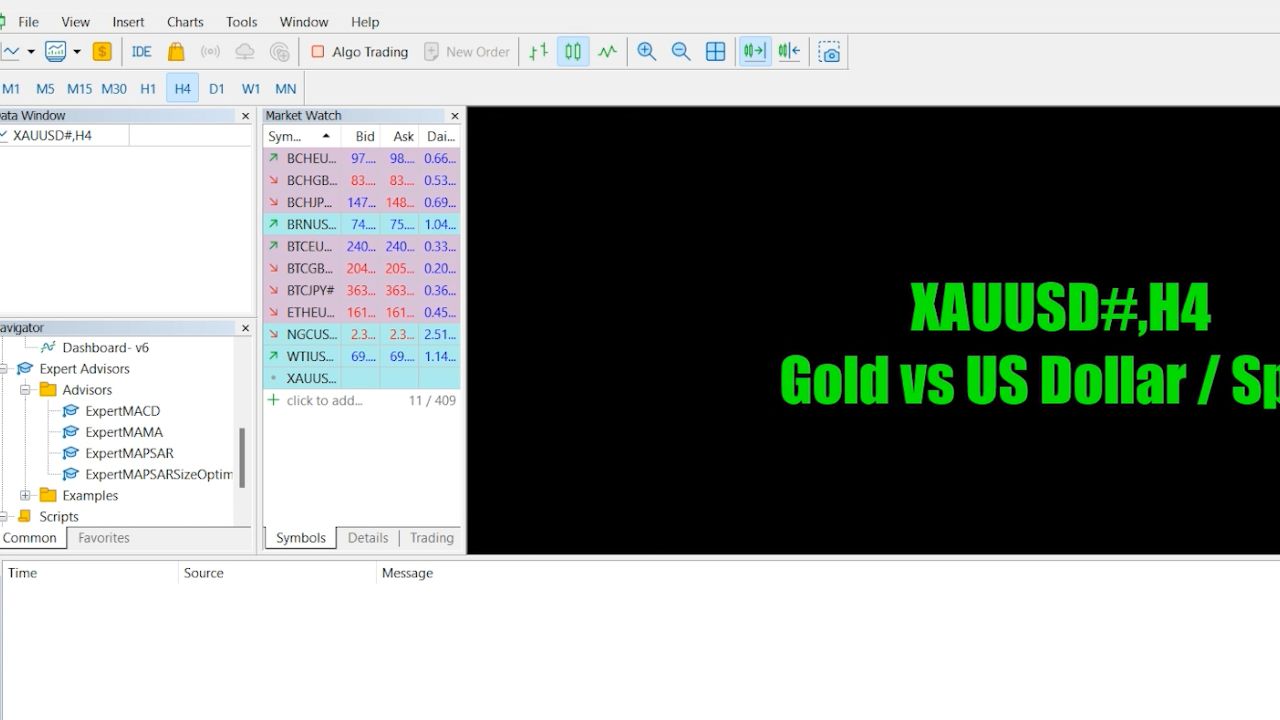

In this insightful presentation, the presenter immerses viewers into the realm of Forex trading, focusing on the instruments available and guiding them on making informed choices. The audience is led to explore the variety of options within the Forex market. The primary focus starts with currency pairs, highlighting major, minor, and exotic pairs, each with its own characteristics and dynamics. The presentation extends to other trading instruments, including commodities like gold, silver, oil, and natural gas, as well as stock indices representing the overall performance of specific economies. Contracts for difference (CFDs) are introduced, providing traders with the flexibility to speculate on various assets without owning them, including stocks, commodities, and cryptocurrencies. Moving forward, the presentation offers guidance on how to select the right trading instruments. Key factors are discussed, such as market knowledge, alignment with one's trading strategy, and consideration of risk tolerance. The importance of staying informed about economic indicators, news, and geopolitical events is underscored. The conclusion emphasizes the diversity and depth of choices within the Forex market, encouraging continuous education, adaptability, and the development of strong trading skills. The presentation extends an invitation to further exploration, highlighting the potential for success through trading strategies, risk management, and market analysis. As the presentation concludes, the audience is invited to join the journey of mastering Forex trading, armed with knowledge and skills to navigate the vast array of trading instruments effectively.

In this enlightening presentation, the presenter guides viewers on a comprehensive journey through the intricate world of Forex currency pairs. The focus is placed on understanding the three distinct types of currency pairs and mastering the art of identifying them accurately. The presentation begins by emphasizing the foundational role of currency pairs in Forex trading. It delves into the three main categories: 1. Major Currency Pairs: The audience is introduced to major pairs, which comprise the most actively traded currencies, including the US dollar (USD). Examples such as EUR/USD, GBP/USD, and USD/JPY are highlighted. Major pairs are described by their liquidity, tight spreads, and susceptibility to economic and geopolitical events. 2. Minor Currency Pairs: The concept of minor currency pairs, also known as cross pairs, is explored. These pairs exclude the USD and include currencies from major economies, like EUR/GBP and GBP/JPY. Minor pairs offer unique trading prospects for those well-versed in the economies of the involved countries. 3. Exotic Currency Pairs: The exotic currency pairs category is introduced, comprising major currencies from developed economies paired with those from emerging or less commonly traded economies. Examples such as USD/ZAR and EUR/TRY are mentioned. Exotic pairs are noted for their elevated volatility and wider spreads, necessitating thorough analysis. The presentation further discusses how to distinguish between these types of currency pairs. The following key points are highlighted: 1. Currency Abbreviations: The base or quote currency of major pairs always involves the USD, while minor and exotic pairs involve other major currencies. 2. Liquidity and Trading Volume: Major pairs boast the highest liquidity and trading volumes, followed by minors and exotics. Monitoring trading volume aids in identifying the type. 3. Market Knowledge: A solid comprehension of the economies and geopolitical factors of the countries involved aids in identifying the currency pair type. The presentation concludes by summarizing the insights gained: 1. Major pairs embody globally traded currencies. 2. Minor pairs entail major currencies sans the USD. 3. Exotic pairs blend major and emerging market currencies. The audience is empowered to recognize currency pair types based on currency abbreviations, trading volume, and market knowledge. Ultimately, the presentation equips viewers with the knowledge required to make informed trading decisions in the complex realm of Forex currency pairs.

In this informative presentation, the presenter delves into the myriad advantages that the international market holds for traders, emphasizing how these factors can significantly enhance their trading experiences and potential for success. The presentation begins by highlighting the global nature of the international market, characterized by its interconnected financial hubs, which provides traders with unique opportunities. The following advantages are then explored: 1. 24-Hour Market: The international market operates around the clock, allowing traders to engage at their convenience across different time zones, enabling flexibility and the capture of diverse opportunities. 2. Market Liquidity: With substantial liquidity, the international market permits seamless entry and exit from positions, reducing the impact of price fluctuations and enhancing trading opportunities. 3. Diverse Range of Instruments: Apart from Forex, traders can access commodities, indices, stocks, and cryptocurrencies, enabling exploration of various markets and adaptable strategies. 4. Volatility: Influenced by diverse economic, political, and social factors, the international market showcases higher volatility, providing traders with opportunities to capitalize on price movements and apply diverse trading strategies. 5. Access to Global Market News: Traders benefit from a wealth of global market news and information, allowing them to make informed decisions based on economic indicators, geopolitical events, and central bank decisions. 6. Market Efficiency: The international market's efficiency ensures fair and competitive pricing, reduced market manipulation, and enhanced transparency in trading. 7. Diversification: Engaging in international trading permits diversification across currency pairs, commodities, and indices from multiple countries, mitigating risks and unlocking simultaneous opportunities. Additionally, the presentation underscores the advantage of high leverage, enabling traders to control larger positions with less capital, thereby amplifying potential profits. However, it is emphasized that leverage also increases risk, requiring careful risk management strategies. The presentation concludes by emphasizing that by leveraging these advantages, traders can broaden their trading horizons, seize global opportunities, and pursue consistent profitability. Moreover, it reiterates the importance of responsible trading, effective risk management, and a comprehensive understanding of leverage to ensure sustained success.

In this educational presentation, the presenter takes the audience on a comprehensive exploration of the concepts of profit and loss in the trading world, emphasizing their fundamental role in the dynamic trading environment. The presentation commences by clarifying the significance of profit and loss in trading, elucidating their central place in a trader's endeavors. The following key aspects are then meticulously examined: 1. Profit Generation Process: The presenter elucidates the mechanism through which traders generate profit by successfully speculating on price movements. This entails buying assets at lower prices and selling them at higher prices in "long" positions, or selling assets at higher prices and buying them back at lower prices in "short" positions. 2. Market Analysis and Strategies: To facilitate successful speculation, the presenter underscores the importance of analyzing market trends, employing various indicators, and formulating strategies to identify profitable opportunities. Skillful prediction of price movements enables traders to execute trades at optimal entry and exit points, thus maximizing potential profits. 3. Risk and Loss Management: The presentation candidly acknowledges the possibility of trading losses, illustrating how they arise when traders' predictions prove inaccurate. To mitigate this risk, the importance of effective risk management techniques is highlighted, including setting stop-loss orders and evaluating risk-reward ratios. 4. Emotional Discipline and Psychology: Trading's psychological dimension is also addressed. Emotions like fear, greed, and impatience can significantly influence trading decisions. The presentation emphasizes the value of cultivating emotional discipline, adhering to trading plans, and mastering emotions to ensure sound decision-making. 5. Monitoring Trades and Continuous Learning: The presenter stresses the importance of vigilantly monitoring trades, closing positions to realize profits, and exiting positions to mitigate losses. Moreover, the presentation accentuates the significance of continuous learning, wherein traders analyze past trades, refine strategies, and learn from both successes and setbacks. Ultimately, the presentation underscores that trading is a dynamic journey characterized by the interplay of profit and loss. It encourages traders to embrace the learning process, adopt effective risk management, and develop emotional discipline to cultivate sustainable trading success. The presentation concludes by highlighting the significance of a well-rounded approach, encompassing clear understanding of profit and loss dynamics, robust risk management techniques, and a commitment to ongoing growth and refinement as traders traverse the exciting world of trading.

In this informative presentation, the presenter takes the audience on a comprehensive journey through the fundamental terms and concepts crucial for understanding and succeeding in the Forex trading environment. The presentation begins by introducing the audience to the key terminology, providing succinct explanations and visual aids for better comprehension: 1. Currency Pairs: The foundation of Forex trading is introduced through the concept of currency pairs, where one currency is traded against another. The presenter emphasizes the significance of grasping these pairs as the basis of all Forex transactions. 2. Pip: The smallest unit of measurement in Forex, a Pip's role in calculating profits and losses is underscored. It's adeptly explained that Pips denote incremental movements in exchange rates. 3. Ask Price and Bid Price: The presenter succinctly defines these terms, elucidating how they denote the prices at which traders can buy and sell currencies, respectively. The crucial concept of "spread" (the difference between these prices) is also introduced. 4. Lot: The concept of "Lot" is clarified, as it represents the standardized trading size. Different types of lots are introduced, giving traders various options based on their trading strategies. 5. Equity and Margin: Equity, the value of a trader's account considering open positions and profits/losses, and Margin, the collateral for leverage, are introduced and their roles explained. 6. Free Margin and Leverage: Free Margin, indicating available funds in a trading account, and Leverage, allowing traders to control larger positions with less capital, are concisely defined. The trade-off between amplified profits and heightened risk due to leverage is highlighted. 7. Position and Pending Orders: The concept of "Position" and "Pending Orders" (instructions to execute trades under specific conditions) are introduced, shedding light on the various ways traders can manage their trades. 8. Trading Styles: Different trading styles are succinctly explained, including Intraday, Swing, Position, and Scalping trading, giving the audience a glimpse into the range of approaches traders can adopt. The presentation artfully encapsulates these terms and concepts, empowering the audience with a foundational understanding of the Forex trading world. It reinforces the importance of continuous learning and practice for mastering these concepts and fostering a successful trading journey.

In "Demystifying Forex Trading: Myths and Facts," the presenter debunks common misconceptions about Forex trading, emphasizing that it's not a get-rich-quick scheme or gambling. The session highlights the importance of dedication, knowledge, and continuous learning for successful trading. It dispels the notion that only financial experts can trade, stressing that anyone can succeed with proper education and discipline. The presenter addresses the accessibility of Forex trading for various capital sizes and clarifies that it can be pursued part-time. While technical analysis is vital, the session emphasizes that success requires a holistic approach incorporating risk management, adaptability, and strategy. Profits are not guaranteed, making a disciplined approach crucial. By debunking these myths and offering insights, the presenter empowers traders with the tools for informed and disciplined Forex trading.

In "The Three Trading Priorities for Success," the presenter outlines the crucial principles that traders should prioritize for sustained success. The first priority emphasizes long-term survival, focusing on effective risk management and preserving capital. The second priority is consistent profit-making, achieved through disciplined trading strategies and risk management. Lastly, while aspiring for high profits is important, it should not compromise the first two priorities. These interconnected principles create a solid foundation for success, with survival leading to consistency and, ultimately, the potential for high profits. By adhering to these priorities, traders can position themselves for thriving in the dynamic world of financial markets.

The 90-90-90 Rule: A Key Principle for Successful Forex Trading" introduces traders to a foundational concept that can significantly impact their success in the Forex market. Explaining the 90-90-90 rule, where 90% of traders lose 90% of their capital within the first 90 days of trading, the presenter highlights the sobering realities of trading while also offering valuable insights for traders to navigate the market effectively. The rule emphasizes the importance of education, risk management, and a long-term mindset. By understanding this rule, traders can approach trading with a realistic perspective, prioritize proper risk management, and position themselves among the successful minority. The rule serves as a call to action, encouraging traders to build a strong foundation for lasting success in the dynamic world of financial markets.

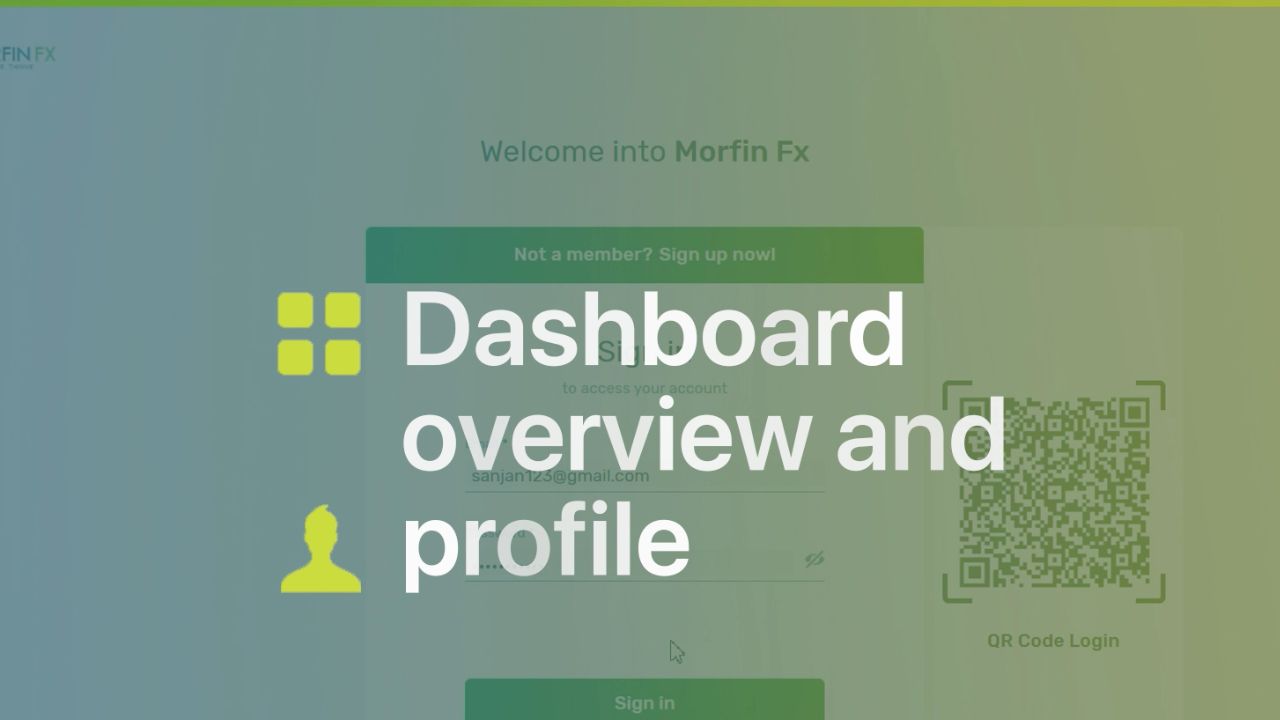

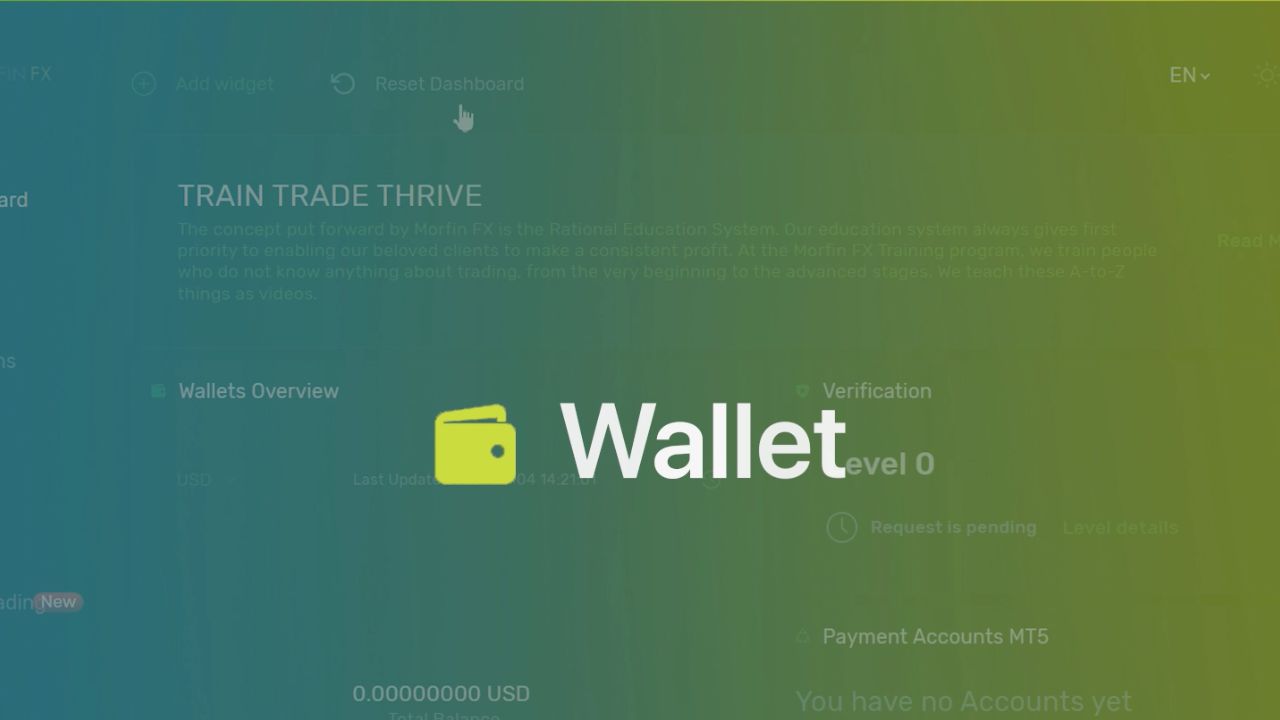

Why Choose a Trusted Forex Broker like Morfin FX" introduces traders to the benefits of selecting a reliable and reputable Forex broker, specifically highlighting the advantages offered by Morfin FX. The presenter emphasizes several compelling reasons to consider Morfin FX as a preferred broker, including cutting-edge technology, competitive trading conditions, regulation and security, educational resources and support, a variety of account types, easy and fast transactions, and a top-tier social trading platform. By underlining Morfin FX's commitment to excellence and traders' success, the presenter encourages viewers to choose a broker that offers a secure, transparent, and supportive trading environment.